India Wants to Be One of the World’s Biggest Arms Exporters

India is seeking to boost arms exports 20-fold in a decade to $3 billion, a push that if successful would transform one of the world’s biggest importers into a major seller of defense equipment.

Steps by Prime Minister Narendra Modi to spur defense manufacturing, if properly implemented, open up the possibility of hitting that figure by 2025, Defense Production Secretary A. K. Gupta said. The challenge is to boost private-sector investment and technological expertise, he said.

“This will not only take us toward the goal of self-reliance in defense production, but will also create tremendous employment opportunities,” Gupta, one of the top bureaucrats in India’s Defense Ministry, said in the interview in New Delhi last month.

“India’s exports target seems ambitious,” said Deba R. Mohanty, a defense analyst and chairman of Indicia Research & Advisory in New Delhi. “If it’s able to meet such targets, then it will in all likelihood be a competitor to many countries, including China.”

The sectors where India has export potential include naval ships, helicopters and components for aircraft, according to consultant PricewaterhouseCoopers LLP.

China’s defense exports reached $1.5 billion in 2014, the eighth-largest in the world in a ranking dominated by the $23.7 billion sold by the U.S., according to IHS Inc. research. India imported $5.6 billion, the most after Saudi Arabia.

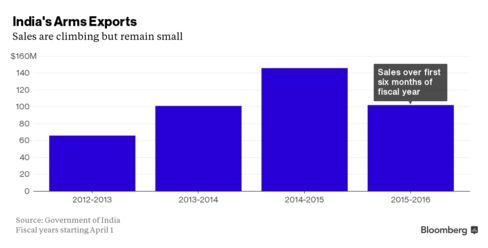

Climbing Shipments

India estimates exports of materiel more than doubled over the two fiscal years ended March 2015 to 9.9 billion rupees ($145 million).

Modi’s policy changes include fewer curbs on foreign investment in defense, looser export controls and a reworked procurement policy that’s set to encourage domestic output. His government has authorized about $65 billion of arms purchases since taking power in May 2014 and is targeting a major naval expansion with locally made ships.

The administration is also sharing the blueprints of state equipment — such as theRustom drone — with the private sector for the first time, to spur technological development and possible overseas sales.

Companies ranging from Larsen & Toubro Ltd., India’s biggest engineer, to Airbus Group SE sense opportunities from less onerous rules and the drive for modernization.

State Companies

But there’s a long way to go.

Modi in April scaled back a long-pending order for 126 Dassault Aviation SA Rafale warplanes, which stalled partly because the tender included the challenge of making 108 of the complex jets at India’s state-run Hindustan Aeronautics Ltd.

In the end, the premier opted for 36 Rafales from France in fly-away condition. France’s Safran SA subsequently shelved plans to make engine parts for Rafale aircraft in India. The episode shows the task Modi faces to catalyze a defense-industrial complex.

State companies account for more than 80 percent of defense production and are already stretched, according to Anurag Garg, a director of defense at Strategy&, a consulting group of PwC. Depending on the private sector to spur exports significantly would need companies to design weapons systems to sell abroad, and that’s no easy task, he said.

The government is trying to do its bit by improving the policy framework, but the push needs the support of industry, said Gupta from the Defense Ministry.

“Industry also needs to come up and accept the challenge,” he said.

Source: http://www.bloomberg.com/news/articles/2016-01-27/india-s-3-billion-arms-export-goal-puts-china-in-modi-s-sights